12 December 2018

31 min read

#Corporate & Commercial Law, #Workplace Relations & Safety, #Data & Privacy, #Competition & Consumer Law, #Procurement, #Property, Planning & Development, #Technology, Media & Telecommunications, #Transport, Shipping & Logistics, #Construction, Infrastructure & Projects

As 2018 rapidly draws to a close, our practice group experts take a magnifying glass to the top issues from the year - and outline what they expect to dominate in 2019.

We examine the key issues in:

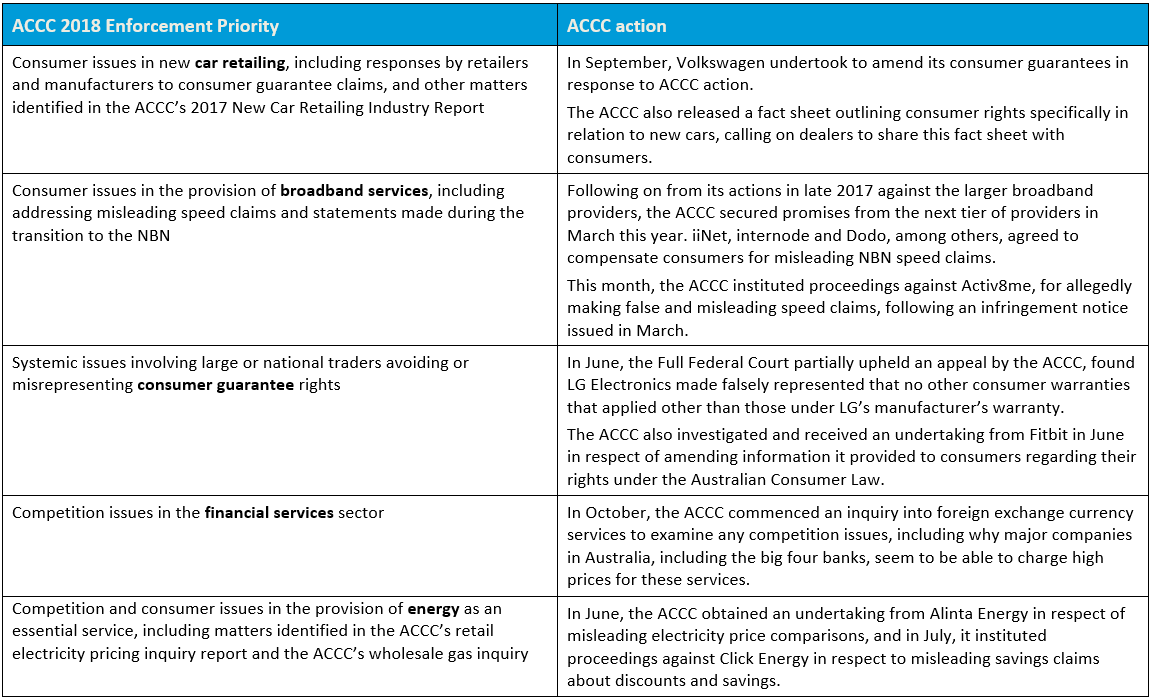

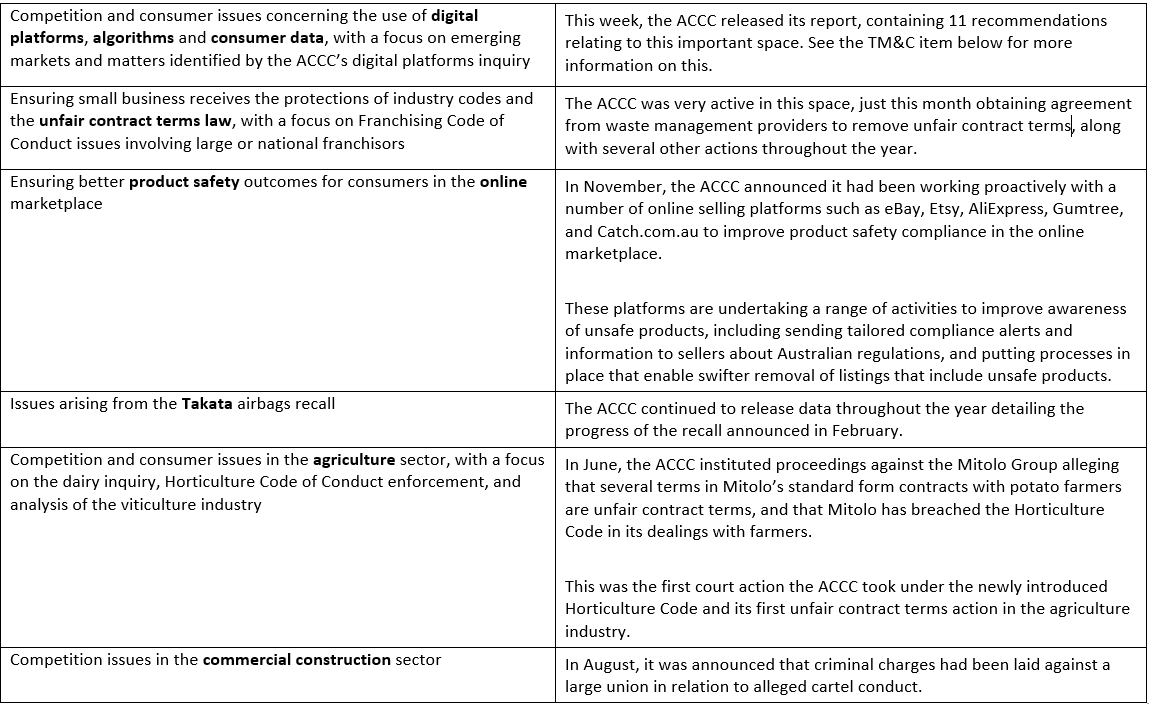

A review of the ACCC's actions this year in relation to its 2018 enforcement priorities

By Dan Pearce & Emily Booth

A brief overview of the actions the ACCC has taken this year in relation to each of its priorities shows how strongly it follows through in its stated areas of focus.

When the ACCC’s 2019 priorities are released early next year, the businesses or industries affected should be on notice that, if action has not already been instituted, it is likely to occur in the ensuing year. This is a regulator intent on delivering.

A year of increased regulation

By Christine Jones & Victoria Gordon

It has been a year of increasing regulation and regulatory change in the construction industry, particularly in NSW, including:

In contrast, there has been an attempt at reducing red tape under the Home Building Act 1989 (NSW) with recent amendments simplifying licencing requirements for builders.

Looking ahead, we will be closely monitoring:

A time of transition

By Suzy Cairney

It has been a year of transition for construction and infrastructure in Queensland. While the residential building market has definitely come off the boil and resources are just starting to pick up again, there are more infrastructure projects (government and private) in the market to help keep the industry busy. In addition, the industry is coming to grips with significant legislative reform and new challenges like non-conforming building products, the non-combustible cladding regulations, and changes to the “ipso facto” rules (affecting mainly termination for insolvency) in the Corporations Act.

As of next week (17 December 2018), the security of payment rules change when most of the new Building Industry Fairness (Security of Payment) Act 2017 (Qld) comes into effect. These changes will have a significant and immediate effect on the industry.

We anticipate that the major trends next year will be a continued focus on management of the various pieces of legislative reform, a continued push for movement towards more collaborative contracting, as well as the continued development and integration of new technology, like BIM and blockchain into the industry. Holistic planning of infrastructure is also likely to gain more traction, especially as programs like City Deals are further developed. What does that mean for construction and infrastructure contracts? Watch this space!

Crackdown on Australian Consumer Law breaches gather steam

By Darren Pereira & Olivia Pasternak

The ACCC’s bid to crackdown on unfair contract terms (UCT) has gathered pace throughout the year. We have summarised their most recent investigation regarding those in the waste management sector using UCT here, as well as their push to strengthen both the ACCC’s and the court’s powers to hold such businesses accountable for their conduct.

Since 2017, when the ACCC announced that UCT was one of their top priorities, we have seen some real action in this area. Only last month the Treasury released a discussion paper seeking feedback from stakeholders on the effectiveness of the UCT provisions (see here). The ACCC have noted that they hope this leads to “toughening up” of UCT laws in order to encourage large businesses to toe the line.

The Federal Government also recently passed a bill increasing the maximum civil pecuniary penalties that a court may impose for breaches of the ACL. We have summarised the changes which bring penalties for breaches of the ACL in line with breaches of competition law in greater detail here.

Law reform and ACCC investigations are an ongoing issue that we will keep you updated on.

Data & Privacy acronym of the year: GDPR. Will it last through 2019?

The extraterritorial reach of the General Data Protection Regulation (GDPR) has put privacy on the business roadmap in Australia in a way that dwarfs the introduction of the notifiable data breach regime in February.

GDPR is bringing the risks of privacy to management and boardrooms with a new focus on data governance as privacy becomes mainstream and privacy risk becomes a central part of the business risk landscape.

Breaches continue on a daily basis and fines continue to be levied by a range of regulators.

While cyber breaches are part of the equation, human error continues as a key underlying cause of privacy breaches, and is the reason we think that 2019 will be a year in which GDPR becomes ubiquitous.

New national modern slavery laws and legal challenge for government tenders at the top of the agenda

By Scott Alden & Victoria Gordon

It has been a momentous year for procurement in two key areas.

We have seen the enactment of both Commonwealth and NSW state modern slavery legislation in Australia, reflecting a growing awareness for the need to address modern slavery both domestically and internationally.

The Modern Slavery Act 2018 (Cth) recently passed both houses of parliament and now awaits royal assent as the final step to enactment.

The laws require entities in Australia that have an annual consolidated revenue of more than $100 million to report annually on the risks of modern slavery in their operations and supply chains, and describe their actions to address those risks.

NSW has also introduced similar legislation to combat this issue, although there are some interesting differences between the two regimes which we expect to see further fleshed out next year.

The other significant change in procurement this year is the passing of the Government Procurement (Judicial Review) Act 2018 (Cth) which (once commenced) will provide suppliers with a statutory platform to challenge a government procurement process in the Federal Court of Australia or Federal Circuit Court of Australia for a breach of the Commonwealth Procurement Rules (CPRs).

This is the first time in Australia that tenderers will have a statutory avenue to challenge government procurement; no longer having to rely on existing remedies for breach of process contract, misleading and deceptive conduct or judicial review under administrative law.

As well as these significant legislative changes there is also increased pressure on business and government to conduct procurement using sustainable processes, especially since the world’s first International Standard for sustainable procurement - ISO 20400 – was published last year.

Looking forward, both public and private organisations must now be more acutely aware of the consequences of choices they make regarding what to buy, how to buy it and who to buy it from.

Changes to off-the-plan sales

By Vanya Lozzi & Elly Ashley

On 22 November 2018 the Conveyancing Legislation Amendment Bill 2018 (NSW) (Amendment Act) received assent by both houses of the NSW Government. However the majority of the amendments, including those to the Conveyancing Act relating to off-the-plan sales will not commence until a date to be determined by the NSW Government, which will likely be in mid-2019.

Once commenced, this will be the most significant change to off-the-plan since the NSW Government enacted its changes to sunset date clauses back in 2015. A link to our article regarding the main changes can be found here.

Airbnb

The Fair Trading Amendment (Short-Term Rental Accommodation) Bill 2018 received assent in August this year. While the bill has received assent, the NSW Government has announced that the new legislation will not commence until early 2018. The NSW Government is currently seeking consultation on the Code of Conduct which plays a huge part in the reforms. Click here to see our previous article on these new reforms.

Technology, Media & Communications

A Christmas present from the ACCC: The preliminary report on the Digital Platforms Inquiry

It has been a busy year for the ACCC. Amongst many other matters it has commenced cartel enforcement action, including against high profile financial institutions and bankers, actively enforced the misleading and deceptive conduct provisions of the Competition and Consumer Act 2010 across a wide range of sectors, focussed on enforcement of the unfair contract terms regime to protect small business and consulted on Australia’s potentially “game changing” consumer data right regime.

And now the ACCC has given us a Christmas present, in the form of the preliminary report on the Digital Platforms Inquiry, which is looking at the state of competition in Australia’s media and advertising markets and the impact that digital search engines, social media platforms and other aggregation platforms are having on those markets (see our article considering the terms of reference for the Inquiry here).

At over 300 pages in length, the preliminary report might be a little heavy to take to the beach, but it is essential holiday reading. Many of the preliminary recommendations reflect the ACCC’s view that both Google and Facebook have substantial market power. Google is seen to have substantial market power in the supply of general search services, online search advertising and the supply of news referral services to news media businesses while Facebook’s power is in the supply of social media services, display advertising and (like Google) in the supply of news referral services to news media businesses.

The ACCC will now consult on its preliminary report early in the new year, with the final report to be provided to Government in June. There will be an Australian election before the final report is delivered. Whatever the nature of the Government that receives the final report, it will be considered with interest.

Transport, Shipping & Logistics

Heavy vehicle safety and Chain of Responsibility

The long anticipated changes to the Chain of Responsibility (CoR) aspects of the Heavy Vehicle National Law (HVNL) became reality from 1 October 2018. The changes affect all businesses operating in supply chains using heavy vehicles.

Key changes are the introduction of:

The changes have been complemented by a detailed Master Code of Conduct (prepared with assistance of the Australian Logistics Council) providing important guidance around COR compliance.

Things to watch in transport in 2019

If there is a change of government in Canberra, expect to see a return of Safe Rates/Road Safety Remuneration Tribunal (RSRT). The RSRT in its previous iteration was highly controversial in its attempt to link heavy vehicle freight rates to road safety outcomes.

Port infrastructure development and security

By Nathan Cecil

A wave of port infrastructure development projects has swept the nation, as ports enhance their facilities and ability to accept ever-larger vessels and/or seek to add berth capacity or new freight capacities (such as container terminals). We have worked on a number of such projects through 2018, many of which are ongoing as part of long term port capacity planning.

On a related note are the additional and growing critical infrastructure and border security concerns. This year has seen the imposition of mandatory data security protocols for declared critical infrastructure assets, including many ports, as well as moves by border authorities to exert greater control over the integrity of cargo operations within ports. In the current ‘security climate’ this will only continue into 2019 and beyond.

As a result, it is becoming increasingly critical for port operators and stakeholders to address port and maritime governance issues as an enterprise risk and compliance obligation, from the very top down.

Transport surcharges

Transport surcharges will be the commercial and political battleground for 2019. The introduction of new surcharges and significant rise in them during recent years has led to increased calls for greater scrutiny and regulation. Most recently, the ACCC has added its voice to this chorus and, in relation to certain landside port charges, recommend that State governments examine the issue in detail and, if warranted, introduce new regulation to control the introduction or rises in such surcharges. There seems to be a limited window for parties on both sides to rebalance the policy and commercial structure of revenue recovery through landside surcharges before governments may be inclined to impose some form of pricing control within the sector. While other new or flagged surcharges aren’t receiving the same heat, the sector in general should expect an heightened level of regulator and Government attention to surcharges and pricing as a result.

Key taxation developments

By Damien Bourke, Kylie Wilson & Paul Thompson

There have been a number of key taxation law developments and changes implemented or proposed recently that affect businesses and companies.

We have outlined the top issues. Click on each heading to see the details.

Other than the reduction to the corporate tax rate to 27.5 per cent, there have been a number of other changes to concessional tax treatment available to small businesses.

The Federal Government has passed legislation that restricts the use of the SBCGT concessions for the sale of assets that are shares in companies or interests in trusts.

Where the asset subject to a CGT event is a share or interest the new legislation adds further conditions for taxpayers to access the SBCGT concessions. In addition to meeting the basic eligibility conditions for the SBCGT the taxpayer is also required to be either:

The following conditions must also be met:

These conditions are aimed at preventing larger entities from being able to access the SBCGT concessions but also add another layer of complexity in determining the eligibility of taxpayers.

This legislation received Assent on 3 October 2018 and will apply to CGT events occurring from 8 February 2018. Entities that have lodged their income tax returns and reported CGT events that may be affected by these changes may be required to amend their tax return.

The Federal Government has extended the $20,000 instant asset write off for small businesses until 30 June 2019.

Businesses with turnover of less than $10 million will be permitted to instantly write off the purchase of capital assets with a cost less than $20,000. Any asset with a cost of $20,000 or more are not able to be immediately deducted in the businesses tax return and will need to be written off over time.

On 1 July 2019 the instant asset write off threshold amount will be reduced to $1,000.

Where a company makes a payment or provides a loan to a shareholder or associated entities of the shareholder these payments may be treated as unfranked dividends unless they are subject to a loan agreement that complies with the provisions in Division 7A of the Income Tax Assessment Act 1936 (Cth) (‘ITAA 36’).

In October and November of this year the Federal Government released a consultation paper for proposed changes to Division 7A loan provisions with the aim of simplifying the operation of the rules and making it easier for taxpayers to comply. It is intended that amendments made will apply from 1 July 2019.

The proposed changes include:

The proposed changes will require such UPEs to be converted into complying loans by 30 June 2020.

The inclusion of a self-correction mechanism to assist taxpayers with promptly rectifying any breaches of Division 7A.

The Australian Taxation Office (‘ATO’) has recently released Taxation Determination TD 2018/13 relating to whether s 109T of the ITAA 36 will apply to a payment or loan made by a company to another entity interposed between the company and a shareholder or a shareholder’s associate where that payment or loan is a commercial transaction.

The tax determination has stated that s 109T will apply to commercial transactions where the Commissioner of Taxation considers that a reasonable person would consider that the payment or loan was made as part of an arrangement to provide a benefit to a shareholder or a shareholder’s associate.

Following on from the 2016 review into the Research & Development (R&D) Tax incentive the Government introduced a bill on 20 September 2018 for the amendment of the R&D tax incentive that has the stated purpose of improving the integrity of the tax incentive.

The proposed amendments include:

Entities with aggregated turnover of $20 million or more for an income tax year will be entitled to a R&D tax offset equal to their corporate tax rate plus one or more marginal intensity premiums. The intensity premiums apply to notional deduction within a range of R&D intensity where the entity’s R&D expenditure (notional deductions) are expressed as a proportion of the entity’s total expenses.

| Tier | R&D intensity range | Intensity premium |

| 1 | Notional deductions representing up to and including 2 per cent of total expenses | 4 percentage points |

| 2 | Notional deductions representing greater than 2 and up and including 5 per cent of total expenses | 6.5 percentage points |

| 3 | Notional deductions representing greater than 5 and up to and including 10 per cent of total expenses | 9 percentage points |

| 4 | Notional deductions representing greater than 10 per cent of total expenses | 12.5 percentage points |

Integrity measures

The Bill also includes measures aimed at enhancing the integrity of the R&D Tax Incentive by ensuring that entities cannot obtain inappropriate tax benefits and by clawing back the benefit of the Incentive to the extent an entity has received another benefit in connection with an R&D activity.

Where an entity benefits from a government recoupment (such as a grant or reimbursement) in relation to expenditure that is also eligible for the R&D tax offset, a clawback applies to reverse the double benefit that arises.

In order to prevent the illegal activity of companies going into liquidation to avoid paying creditors and employee entitlements and then reforming as new companies new measures were announced that create new offences for conducting phoenix activities and prevent Director’s from evading liability or prosecution. The proposed measures also include an extension to the Director’s Penalty Notice (DPN) regime to include taxation liabilities such as GST, luxury car tax and wine equalisation.

Currently the Tax Administration Act 1953 (Cth) allows the Commissioner to make estimates of a company’s unpaid amounts of PAYG Withholding and Superannuation Guarantee charges. The Commissioner can then issue a DPN to the Directors that makes them personally liable for the payment of those liabilities.

The exposure draft for the new legislation includes amendments that will extend the Commissioners ability to make estimates of unpaid liabilities and to issue DPNs for the payment of those liabilities to GST, luxury car tax and Wine equalisation tax.

In addition the measures proposed will authorise the Commissioner to retain tax refunds for a taxpayer who has failed to lodge a return or provide other information that may affect the amount that the Commissioner would be required to refund.

Legal professional privilege

The ATO generally respects Legal Professional Privilege (LPP), however where information that should be subject to LPP has been provided to the ATO through dubious means without the client waiving LPP, the Commissioner asserts that he is obligated to make use of that information to make assessments of the client’s taxable income.

In a proceeding that is set to be heard by the High Court, Glencore has had documents that were part of the Paradise Papers stolen and published. The ATO has obtained copies of these documents and is seeking to rely on them in pursuing Glencore for unpaid tax.

Glencore asserts that the documents are subject to LPP and is seeking an injunction to prevent the ATO from making use of the information.

A previous decision by the Federal Court found that the Commissioner was able to make use of any information available to him for the purposes of forming an assessment regardless of how it came into the Commissioner’s possession.

The decision of the full Federal Court in Pintarich v Deputy Commissioner of Taxation [2018] FCAFC 79 ruled that a taxpayer was unable to rely on correspondence issued by the ATO regarding the details of a payment arrangement he had entered into. The majority judgment of the Court determined that as the correspondence had been automatically generated by a computer and without a mental process accompanying it, the correspondence did not constitute a decision that the taxpayer was entitled to rely upon.

While the facts of the case include conflicting accounts of the discussions between the taxpayer and an ATO officer regarding the terms of the payment arrangement, the decision potentially absolves the ATO of responsibility for any inaccuracies in correspondence that is issued to taxpayers.

The taxpayer had sought leave to appeal in the High Court but his application was refused on the basis that it had insufficient prospects of success.

Clients with settlement agreements for taxation liabilities should exercise caution in regards to correspondence they received from the ATO and may wish to contact the ATO directly if they wish to confirm the contents of the correspondence.

One of the policy announcements made by the Federal Labor Party during the year involves a change to tax offsets for imputation credits on share income.

The proposed changes will make the tax offsets provided by imputation credits non-refundable. Currently where a shareholder has imputation credits that are in excess of their tax liability, the excess amount will be refunded to the shareholder. However, under the proposed changes the imputation credit tax offsets will be lost.

The Labor party has stated that pensioners in receipt of a government pension will be exempt from the changes, however the group that will be most adversely affected are likely to be retirees with Self Managed Superannuation Funds (SMSFs).

As large superannuation funds have aggregated assets they will be able to continue to make use of all of the imputation credits as the members in accumulation phase that are subject to tax. Where all members of a SMSF are in pension phase the income earned on their pension accounts are tax free (subject to the transfer balance cap) and so the tax offsets on the imputation credits are unable to be utilised. A number of retirees have come to rely on the refund of the imputation credits as a part of their income, they may have to consider making changes to the mix of investments in their superannuation fund if the proposed changes ultimately eventuate after the next federal election.

A growing focus on casual employees

This year has seen a significant focus on casual employees in the Australian workplace, raising more questions than has been answered.

The controversial WorkPac decision of the full Federal Court (WorkPac Pty Ltd v Skene [2018] FCAFC 131) has rejected the commonly understood position that an employee designated as a casual under an award or enterprise agreement is a casual for all purposes.

This decision brought uncertainty for employers who previously treated casuals on the assumption that they were not entitled to any leave or termination entitlements. It also opened the possibility that employers could face significant penalties for not paying their staff the correct entitlements. (See our article on ‘Are your casual employees actually casuals’).

Shortly after the WorkPac decision, the Fair Work Commission model casual conversion clause came into operation from 1 October 2018 into more than 80 effected modern awards.

This followed the Fair Work Commissions landmark ruling in July 2017 in which it determined to provide certain casuals with a right to request conversion to permanent employment. The new changes required employers to notify casual employees of their right to request to convert by 1 January 2019 if they are an existing employee or within the first 12 months of the employee’s first engagement to perform work. While this right existed in a few modern awards, the extension to over 80 awards has significantly increased the rights of casual employees who having worked a pattern of hours on an ongoing basis for 12 months, without significant adjustment, could request that the business convert them to permanent employment.

An employer receiving the request would have to consult with the employee and only refuse the request in writing within 21 days of the request being made, on the basis of ‘reasonable grounds’. For more information see our article ‘Casual employees can now request to be permanent’.

And further complications for employers arose out of the Fair Work Commissions decision in the Foodora case where the commission found a worker was not an independent contractor but more likely was a casual employee. Although that case depended on the particular facts of the matter, including that the worker was swapping ‘shifts’ with other delivery riders it exposes a weakness for employers looking to engage labour other than as causal employees. The administrator for Foodora estimated workers had been underpaid $5.5million based on a conclusion that ‘it is more likely than not that the delivery riders and drivers should have been classified as causal employees instead of contractors’.

And most recently the Federal Government has indicated it may look to announce significant changes to casual worker arrangements to provide legislative certainty and safe guards for employers around casual employment.

In 2019, employers will need to closely follow developments in this area if they are to ensure they maintain a flexible workforce with minimal risk of breaching workplace laws.

Contacts

Competition & Consumer

Dan Pearce, Partner

T: +61 3 9321 9841

E: dan.pearce@holdingredlich.com

Construction & Infrastructure

Christine Jones, Partner

T: +61 2 8083 0477

E: christine.jones@holdingredlich.com

Suzy Cairney, Partner

T: +61 7 3135 0684

E: suzy.cairney@holdingredlich.com

Corporate & Commercial

Darren Pereira, Partner

T: +61 2 8083 0487

E: darren.pereira@holdingredlich.com

Data & Privacy

Lyn Nicholson, General Counsel

T: +61 2 8083 0463

E: lyn.nicholson@holdingredlich.com

Procurement

Scott Alden, Partner

T: +61 2 8083 0419

E: scott.alden@holdingredlich.com

Property & Real Estate

Vanya Lozzi, Partner

T: +61 2 8083 0462

E: vanya.lozzi@holdingredlich.com

Technology, Media & Communications

Angela Flannery, Partner

T: +61 2 8083 0448

E: angela.flannery@holdingredlich.com

Transport, Shipping & Logistics

Geoff Farnsworth, Partner

T: +61 2 8083 0416

E: geoff.farnsworth@holdingredlich.com

Nathan Cecil, Partner

T: +61 2 8083 0429

E: nathan.cecil@holdingredlich.com

Workplace Relations & Safety

Michael Selinger, Partner

T: +61 2 8083 0430

E: michael.selinger@holdingredlich.com

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this publication is accurate at the date it is received or that it will continue to be accurate in the future. We are not responsible for the information of any source to which a link is provided or reference is made and exclude all liability in connection with use of these sources.